Table of Content

A borrower is treated as paying any points that a home seller pays for the borrower's mortgage. You meet the rules to deduct all of the mortgage interest on your loan and all of the real estate taxes on your main home. If you pay interest in advance for a period that goes beyond the end of the tax year, you must spread this interest over the tax years to which it applies. You can deduct in each year only the interest that qualifies as home mortgage interest for that year. However, there is an exception that applies to points, discussed later. You can treat a home you own under a time-sharing plan as a qualified home if it meets all the requirements.

You just can’t take the interest deduction on the amount used for those purposes, Ms. Weston said. "It can be a savvy way to accelerate your debt repayment and minimize interest charges for disciplined homeowners," said McBride. You should know that under the Tax Cuts and Jobs Act, you can only deduct the interest on the debt if you used your HELOC or home equity loan to buy, build or substantially improve the home that secured the loan.

Rules for Deducting Home Equity Loan Interest

Maurie Backman writes about current events affecting small businesses for The Ascent and The Motley Fool. A HELOC, or home equity line of credit, isn't a loan in the classic sense. These are all worth exploring if you need to borrow money. Each week, you'll get a crash course on the biggest issues to make your next financial decision the right one. “Helping to pay for current bills is not a good reason to put that asset at risk,” Ward says.

Moss Adams LLP and its affiliates assume no obligation to provide notification of changes in tax laws or other factors that could affect the information provided. Starting this year, you can only deduct interest on $750,000 of qualified residence loans, including your mortgage and HELOC. On the other hand, if you do obtain home equity debt used for qualified purposes, not only do you still get to deduct the interest, but in many cases, the deduction could be even better.

Pay

Our flexible underwriting standards are also suited for sub-par credit scores. In the best case scenario, you’ll have a better choice withno monthly payments. Let’s look at an example to understand DTI calculations. All his credit card payments, student loans, property taxes, property insurance premiums, mortgages, and alimony payments add up to $60,000 this year. Therefore John’s DTI would be 60% ($60,000 / $100,000). That’s substantially over the 43% maximum, so he probably won’t qualify.

If your loan period is more than 10 years, the terms of your loan are the same as other loans offered in your area for the same or longer period. Payments on a nonredeemable ground rent aren't mortgage interest. You can deduct them as rent if they are a business expense or if they are for rental property. 530 for more information on the mortgage interest credit. This section describes certain items that can be included as home mortgage interest and others that can't.

Share this Article

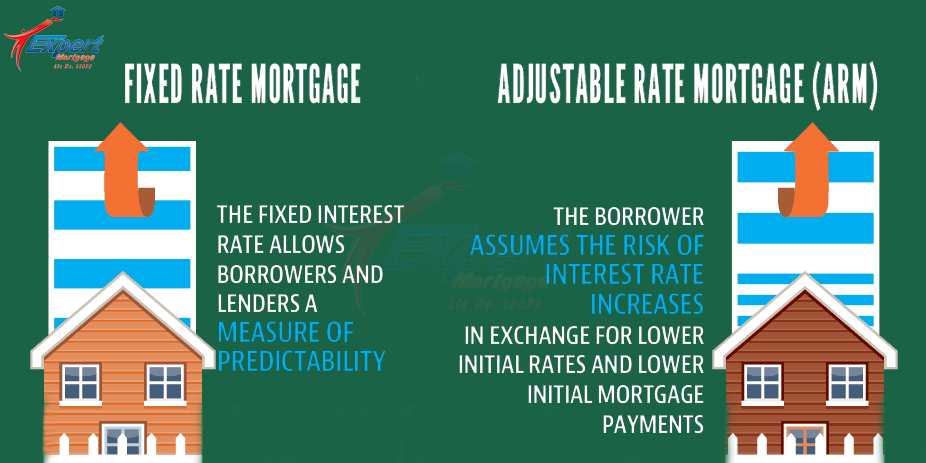

The changes introduced under the TCJA include a reduction of the cap on the mortgage interest deduction. The deduction can be claimed only for the interest paid on mortgage debt up to $750,000 if the loan was taken out after Dec. 15, 2017. A home equity line of credit, or HELOC, is another way to borrow using the equity in your home as collateral.

Assurance, tax, and consulting offered through Moss Adams LLP. ISO/IEC services offered through Cadence Assurance LLC, a Moss Adams company. Investment advisory offered through Moss Adams Wealth Advisors LLC. Services from India provided by Moss Adams LLP. Wealth management offered through Moss Adams Wealth Advisors LLC. Services from India provided by Moss Adams LLP. If you’d like to learn more about how the new tax laws will impact you, contact your Moss Adams professional.

How These Rates Are Calculated

Lenders will typically allow homeowners to borrow anywhere from 70% to 85% of the value in their home. Here are some of the most common questions about home equity & bad credit so you can decide whether one of these loans is right for you and your financial situation. Interested in using the loan proceeds to improve their home or financial outlook. Home equity loans are loan products that have a dark side and a light side, kind of like The Force.

You can revoke your choice only with the consent of the IRS. If no, go to part II of this publication to determine the limits on your deductible home mortgage interest. For more detailed definitions of grandfathered debt and home acquisition debt. Explains how your deduction for home mortgage interest may be limited. It contains Table 1, which is a worksheet you can use to figure the limit on your deduction.

This rule applies to your main home and to a second home that you treat as a qualified home. If your main home no longer qualifies as your main home, you can choose to treat it as your second home as of the day you stop using it as your main home. If you get a new home during the year, you can choose to treat the new home as your second home as of the day you buy it. If you have more than one second home, you can treat only one as the qualified second home during any year. However, you can change the home you treat as a second home during the year in the following situations.

Go to IRS.gov/Forms to view, download, or print all the forms, instructions, and publications you may need. Or, you can go to IRS.gov/OrderForms to place an order. Form 9000, Alternative Media Preference, or Form 9000 allows you to elect to receive certain types of written correspondence in the following formats. The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals. The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. For a home equity loan, you can deduct the interest on up to $750,000 of the loan. This cap applies to loans taken out after Dec. 15, 2017. For loans obtained before that date, the cap is $1 million. Amanda Jackson has expertise in personal finance, investing, and social services. She is a library professional, transcriptionist, editor, and fact-checker.

No comments:

Post a Comment